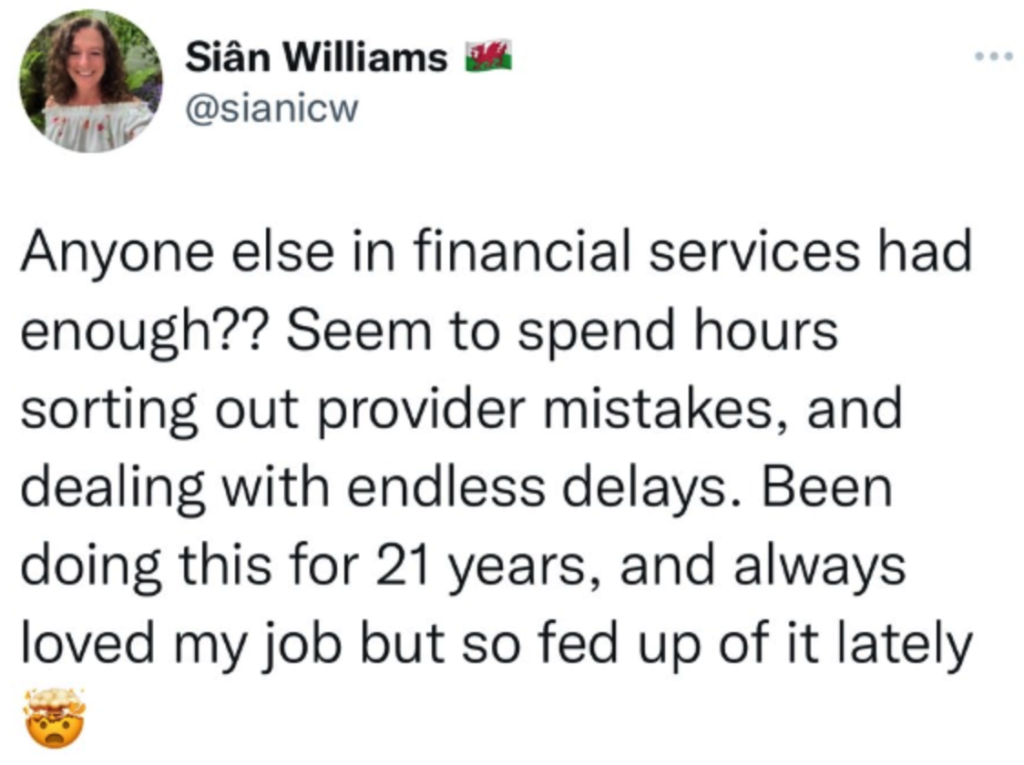

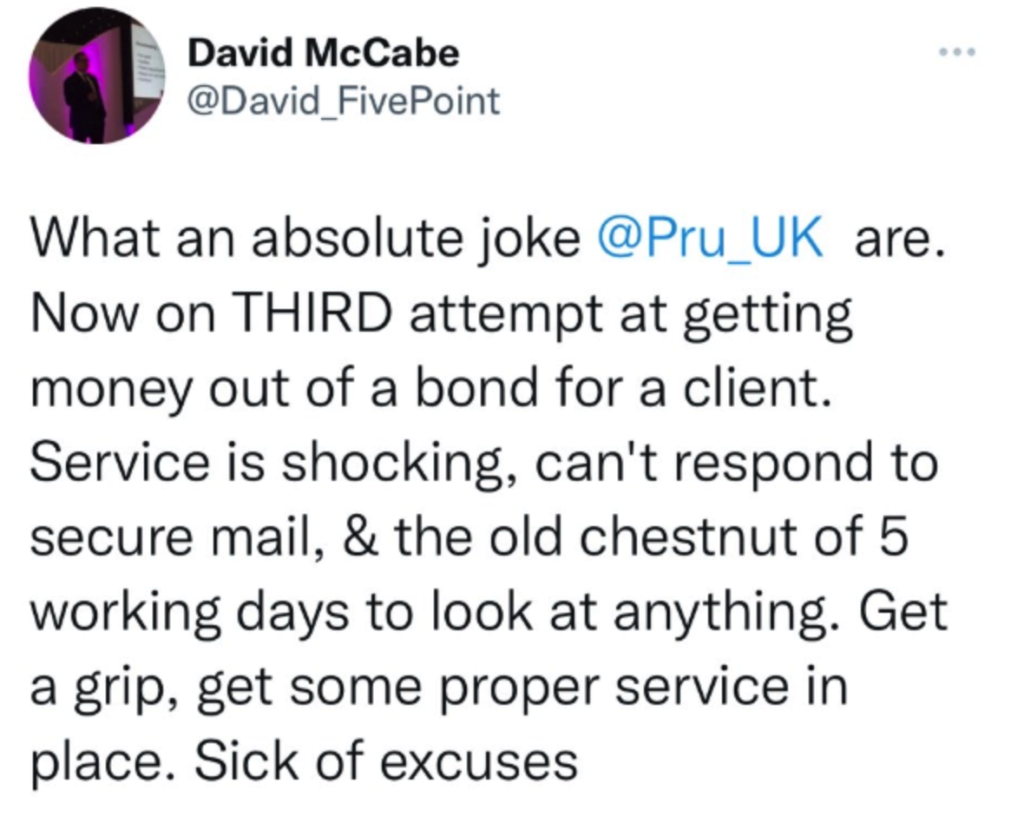

Dealing with providers – everyone’s least favourite part of financial services at the best of times, right? We joke about it with our new trainees; how we hope they enjoy the sound of Greensleeves, or being told that 2 + 2 = 7. It’s just a fact of finance life. But… it seems to be getting far worse recently. Here’s a couple of tweets, just in the last 24 hours:

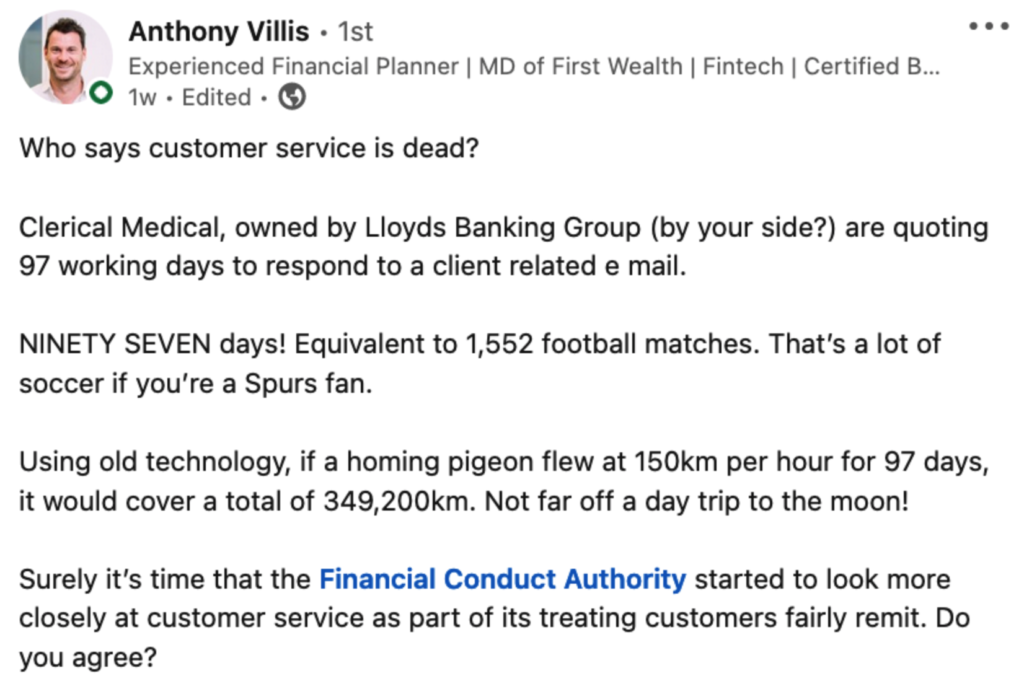

I also spoke to an adviser recently who has compiled a dossier of the challenges she has had with certain providers recently – it is pretty damning. Her point is that these companies are making it physically impossible for her to work with them. Which shifts the dynamic on the burden of recommendation; rather than the default being to stay where they are and only recommend a change if there is an objectively suitable alternative, it costs her company and team money to service the client with the existing poor provider. And so it’s difficult to justify recommending no change to the provider; if the client wants adviser support, it is going to be disproportionately more expensive to provide by maintaining where they are, and how exactly do you factor that into a charge comparison?

Another firm got in touch with us recently to ask if we have any special, magical numbers, like a hotline, that helps us get better service from providers (we wish!) as they were tearing their hair out with one provider () quoting 93 days…! She was not alone in being quoted these timescales…

Eclipse Archives Industry Insight Latest News Popular

URGENT: LTA Abolition

HMRC kindly issued a newsletter on 4th April advising clients to delay taking their pension benefits or transferring until it can fix incorrect [...]

Group News

Say hello to our trainers!

As part of our ongoing commitment to excellence, we’ve recently welcomed an awesome duo to our training dream team. We introduced a new [...]

Latest News Popular Press

Spring Budget 24

The spring budget comes and goes with no major changes to the world of financial planning. There are however some announcements and changes [...]

Eclipse Archives Group News Latest

Common ‘Training’?

I can’t get Pulp’s ‘Do You Remember the First Time’ out of my head. I’m pretty sure that Jarvis had other things on [...]

Eclipse Archives Industry Insight Latest

Stellar Compliance

You may have spotted that this week we hosted our monthly TALK event, and this month we were joined by Gillian Hepburn, Benchmark, [...]

Group News Latest

And who do we have here?

We have yet more exciting internal news to share, following a shake-up in a section of our client relations department – with two [...]

Group News Latest News Press

In the press

It’s been a busy January so far! We’ve had a few of our team speak with some press about some hot topics in [...]

Eclipse Archives Industry Insight

COO Survival Guide

Recently Cathi has been talking about sector-agnostic technology and how we can look to the efficiencies in other businesses to enhance what we [...]