In our day-to-day work as paraplanners, we regularly see recommendations in regards to surrendering investment bonds for a variety of reasons. For example, restructuring investments more tax efficiently, poor performance, and to reset the 5% allowance clock.

As a surrender is a chargeable event, if there’s a gain crystallised, there can be tax to pay depending on the bond owner’s situation; including the bond type, whether it’s onshore or offshore, and their income tax position.

In the event of tax being payable, the bond owner may decide to pay this, or they might stagger the surrender over a number of tax years to avoid paying any unnecessary tax. This could be tax payable on the gain itself or, if it pushes their adjusted net income over £100,000, extra tax on their income as a result of losing part or all of their personal allowance.

But is there anything else we should be considering?

If a bond owner has been a non-resident at any point during the life of the policy, then they could be eligible for Time Apportionment Relief (TAR), which could be used to reduce the gain and, as a result, the tax payable. Especially as it is the reduced gain that would be added to their ‘adjusted net income’ to determine if the personal allowance will be reduced.

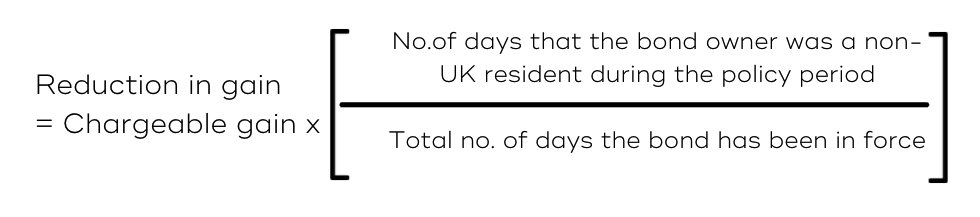

The TAR formula

The application

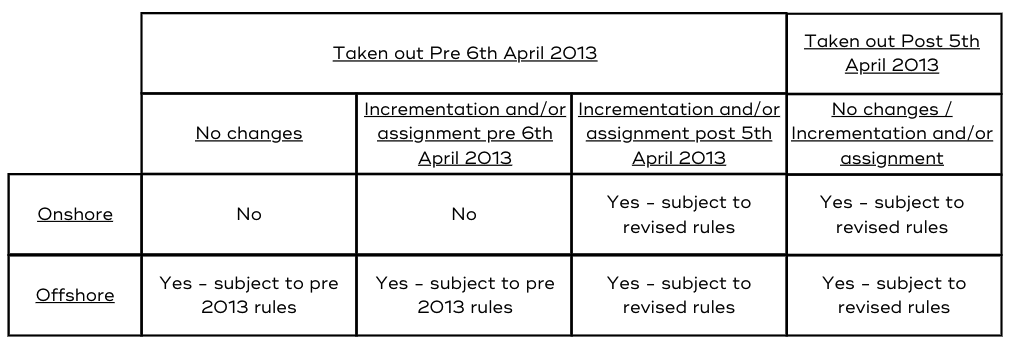

TAR can apply to gains from offshore bonds regardless of when the plans were taken out, but this isn’t the case for onshore bonds. The rules only changed to include gains from onshore bonds as well with effect from 6th April 2013.

These revised rules also stated that relief should be calculated based on the non-residency and ownership of the person responsible for paying the tax at the time of surrender. So, if the plan had changed ownership, the relief would be based on any non-residency since the assignment occurred, rather than the whole term. This can have significant implications when the ownership has changed hands; although, there is an exception for assignments between spouses/civil partners living together.

So, does this mean TAR can’t be applied to gains from onshore bonds taken out before the rule change came into effect?

Yes, and no…

TAR can be applied to gains from onshore bonds taken out before this date but only if the plan has been incremented, i.e., topped up, or assigned after the 6th April 2013. Such an action will bring the onshore bond under the remit of the revised rules, which caters for both offshore and onshore bonds.

To summarise

Is TAR available? And, if so, what rules should we be looking at?

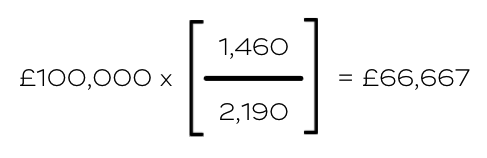

The TAR formula in practice:

Jeff wants to surrender his offshore bond that he’s held for 2,190 days. The chargeable gain upon surrender has been calculated as £100,000. Jeff was a non-UK resident for 1,460 days of the policy period, but is now a UK resident again.

The reduction in gain would be calculated as follows:

The gain after TAR would therefore be £33,333 (£100,000 – £66,667).

So, as you can see, the impact of TAR can be quite significant!

Please note, however, the application of TAR can influence other elements of the tax calculations, including how top slicing relief is calculated. It is therefore important to thoroughly read up on the full rules beforehand.

Eclipse Archives Industry Insight Popular

What’s your mastermind subject?

I’m here to talk branding. Anyone who knows me knows it’s my Mastermind subject. And, if you don’t know me, I’m Natalie Bell, [...]

Eclipse Archives Industry Insight Latest News Popular

URGENT: LTA Abolition

HMRC kindly issued a newsletter on 4th April advising clients to delay taking their pension benefits or transferring until it can fix incorrect [...]

Group News

Say hello to our trainers!

As part of our ongoing commitment to excellence, we’ve recently welcomed an awesome duo to our training dream team. We introduced a new [...]

Latest News Popular Press

Spring Budget 24

The spring budget comes and goes with no major changes to the world of financial planning. There are however some announcements and changes [...]

Eclipse Archives Group News Latest

Common ‘Training’?

I can’t get Pulp’s ‘Do You Remember the First Time’ out of my head. I’m pretty sure that Jarvis had other things on [...]

Eclipse Archives Industry Insight Latest

Stellar Compliance

You may have spotted that this week we hosted our monthly TALK event, and this month we were joined by Gillian Hepburn, Benchmark, [...]

Group News Latest

And who do we have here?

We have yet more exciting internal news to share, following a shake-up in a section of our client relations department – with two [...]

Group News Latest News Press

In the press

It’s been a busy January so far! We’ve had a few of our team speak with some press about some hot topics in [...]